Tax season is arrived. Income tax returns (ITR) must be submitted before date. If you have a few minutes to spare, you may file your taxes online using one of the many free services that are accessible. Every Indian citizen who has income that is subject to taxation is required to file income tax returns (ITR). The filing of income tax returns enables taxpayers to request a refund of any excess tax that was paid or deducted during the fiscal year.

E-filing refers to the procedure of submitting an IT Return online. ITR filing is possible through a government of India internet platform. Additionally, a few commercial companies that the IT Department has registered allow electronic filing through their websites. These websites offer services for a fee on some and for free on others.

The Income Tax Department of India now requires all Indian nationals to file and submit an Income Tax Return (ITR) in line with their incomes. It includes information on their financial situation as well as the taxes they owe for that fiscal year. Both offline and online e-filing, which entails submitting the tax return digitally online, are options for ITR submission.

1. ITDindia

2. ClearTax

3. TaxBuddy

4. myITreturn

5. All India ITR

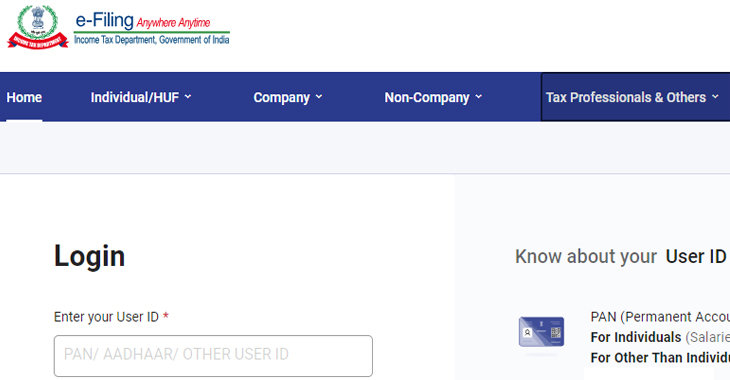

1. ITD Goverment of india

This is the official website of the Ministry of Finance, Income Tax Department, and the Government of India. For managing their income tax issues, both individuals and enterprises in India turn to this service. This user-friendly website offers a comprehensive resource for all kinds of tax-related information, services, and resources. The website makes it simple for taxpayers to file their financial income tax forms online. One of the main goals of our website is to guarantee an easy, quick process. It offers a thorough, step-by-step tutorial for submitting an ITR.

The website offers a wide variety of features and services in addition to returns. Users can use tax calculators to figure out their financial obligations, start an online tax payment, and track the development of their returns by downloading various tax forms. Additionally, they can keep up with the most recent notices, circulars, and suggestions from the Income Tax Department.

In all interactions with the taxpayer, the Department shall offer prompt, cordial, and expert help. The Department is required to implement a fair and impartial system and swiftly settle any tax-related disputes. When enforcing tax law, the Department must appropriately consider the cost of compliance. Every taxpayer may select a personal authorised representative, subject to Department approval.

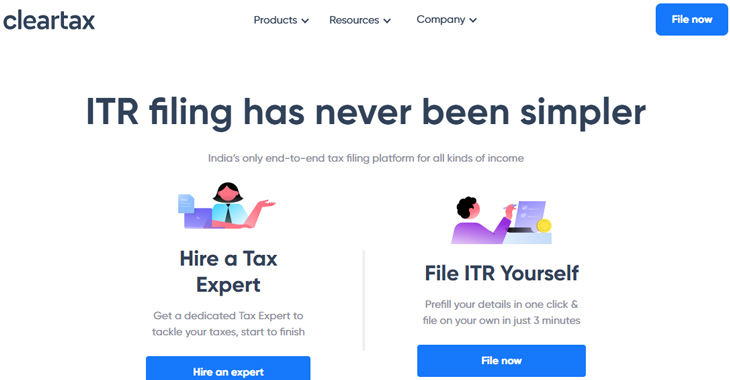

2. ClearTax

Indians can file their income taxes via the well-known online platform Clear Tax, which also provides additional services linked to compliance. The website’s user-friendly design makes it simple and effective for both people and businesses to utilise. This well-known online resource in India offers a variety of services for submitting income taxes and other types of compliance. It has a user-friendly design that aims to make submitting income tax files for both individuals and businesses simple and effective.

The website ClearTax differs from other ITR filing websites in that it offers both free and paid services, allowing users to select the one that best meets their needs. With features like pre-filled documentation, automated calculation, and instant validation, it also expedites the tax filing process and helps taxpayers ensure correctness and compliance. Additionally, ClearTax provides its users with the chance to receive professional advice and direction, making it a reliable and approachable choice for issues relating to income taxes.

The website offers both free and paid services, allowing users to choose the one that best suits their needs. The website’s pre-filled forms, automated calculations, and instant validation speed up the tax filing process while allowing compliance and accuracy. The website is reliable since it offers expert assistance and direction. Without logging into the website, one can submit an ITR immediately using ClearTax.

3. Taxsmile

When it comes to completing income tax returns online, TaxSmile was a pioneer. Similar to Clear Tax, it offers expert tax return management options starting at 499INR. There is an additional choice, though—you can do your tax returns on your own.

When a user submits an ITRV via the company’s website, TaxSmile takes care of confirming it before sending it to the CPC for confirmation. Users of TaxSmile have access to a centralised database that can be used to manage documents, track refunds, store year-by-year historical tax filing data, and even offer support for any problems that may arise during the online filing of income tax returns.

It is a very user-friendly website because it offers a dedicated helpline number for customer service, an email option for assistance, as well as live chat for questions. As a result, this site has an immediate support system in place. Anyone with a net taxable income under Rs 5 lakhs can use this website to file their tax return for free. In the case of the free service, all the data for electronic filing on this website must be manually entered. This website is less understandable than others and seems a little bit more cluttered, but it is not perplexing.

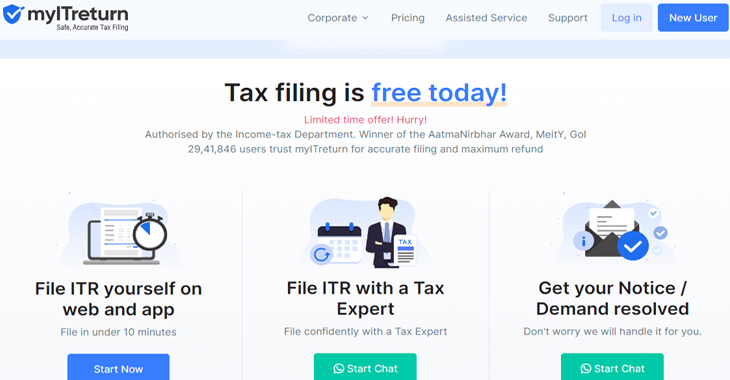

4. myITreturn

It is free to use MyITReturn, an authorised e-return intermediary registered with India’s IT Department. One must respond to few simple questions about their salary, residence, investments, and other matters in order to file an ITR utilising this website. The website calculates the ITR figures based on the responses. By taking these steps, tax filing is made simple and tax refunds are increased. It assists individuals in submitting their Indian income-tax returns and has been acknowledged as a reputable service provider by the Income-tax Department. Additionally, the AatmaNirbhar Award was given to it by MeitY, the Indian government.

Customers may file their taxes more easily thanks to the website’s step-by-step Q&A technique, which makes sure that no important information is missed. The backend staff and the machine learning algorithm also work together to ensure the accuracy of the output. These steps are taken to streamline the tax filing process and increase the amount of any prospective tax refunds. It offers a comprehensive strategy for a range of income tax-related requirements.

5. All India ITR

A certified Government of India intermediary, All India ITR provides a completely paperless way to file income tax returns. The website can also be downloaded as an app through the iOS and Android app stores.

The system automatically reads the inputs and fills out the forms, making it simple to file your ITR on the move. Users must upload photos of PDFs of their Form 16 and additional documents.

Considerations for Selecting ITR Filing Websites: Numerous considerations should be made while picking ITR Filing websites, and people should make their choices in accordance with their unique needs. A few of the crucial elements are as follows:

User-Friendly Layout: Users should choose a platform with an intuitive design that makes it simple for them to navigate and complete the tax filing process. The website should provide clear instructions and user-friendly tools to make filing less cumbersome.

Security precautions: When choosing an ITR filing website, security should come first. Search for websites that have security measures. Your information is protected by these security measures while you submit your income tax forms online.

Customer service: It is in fact crucial to take into account a website that tries to provide a dependable customer assistance system when choosing an ITR filing website. It’s critical that the website has an excellent customer support structure in place to handle any questions or problems users might have while paying their taxes.

Additional services: A website’s reputation and user reviews are very important. For a thorough evaluation of each website’s dependability, effectiveness, and general user experience, users should thoroughly review the discussion boards.

In order to reduce the chance of errors and mistakes, users should also search for built-in validation checks and error correction systems. When choosing a website, these extra elements must to be taken into consideration.

Read More

Top 5 Rainiest Places in India

India’s Top 5 Best Electric Scooters for 2023